| House Passes Securities Regulation

Bill |

|

3/19. The House amended and passed HR 3606

[LOC |

WW], a bill to reduce

securities regulation for small and start up companies. The vote on final passage on

March 8 was 390-23. See, Roll Call

No. 110. The Senate is scheduled to take up this bill the week of March 19.

This bill was introduced on December 8, 2011, as the "Reopening American Capital Markets

to Emerging Growth Companies Act of 2011". As amended by the House, this bill is titled

"Jumpstart Our Business Startups Act" or JOBS Act. As amended, it is a composite of

provisions from several stand alone bills reported by the

House Financial Services Committee (HFSC).

These provisions would reduce securities regulation for small companies. If

enacted into law, this bill would incent the creation of new companies, and facilitate their

raising of capital. It would particularly benefit the technology sector.

Rep. Eric Cantor (R-VA) stated in the House on

March 7 that "Right now it's just too difficult to start up a business. The threat

of higher taxes and increased regulations has small businessmen and -women and

entrepreneurs frozen in their tracks. Small businesses and start-ups simply do

not have the bandwidth to comply with Washington's redtape, and yet they are the

ones we're counting on to create jobs.

Rep. Cantor (at right) said that

"the JOBS Act will get small businesses and entrepreneurs back into the game by removing

costly regulations and making it easier for them to access capital. This legislation also paves

the way for more start-ups and small businesses to go public, which will attract new investors

and will allow small businesses to grow and create jobs." Rep. Cantor (at right) said that

"the JOBS Act will get small businesses and entrepreneurs back into the game by removing

costly regulations and making it easier for them to access capital. This legislation also paves

the way for more start-ups and small businesses to go public, which will attract new investors

and will allow small businesses to grow and create jobs."

Rep. Spencer Bachus (R-AL), Chairman of the HFSC,

stated in a

release on March 8 that "The House has passed more than two dozen bills that will

help grow our economy and create jobs, yet the do-nothing Senate continues to stall. Senator

Reid must allow a vote on these needed bills, including the JOBS Act we’re sending him

today."

The National Venture Capital Association,

Tech America, Information Technology Industry Council (ITIC), and other groups sent a

letter to Senators on March 15 "to urge Senate passage of H.R. 3606,

the JOBS Act. This measure, supported by the Administration, and passed by the House of

Representatives by an overwhelmingly bipartisan margin of 390-23, seeks to modernize the

nation's capital formation rules and provide for a transition into public company regulatory

compliance for emerging growth companies."

|

|

|

| Summary of HR 3606 |

|

3/19. The following is a summary of HR 3606

[LOC |

WW] as

passed by the House on March 8, 2012. As amended, it is titled "Jumpstart Our

Business Startups Act" or JOBS Act". It includes language from several stand alone bills,

along with amendments approved during House consideration.

Title I of the House bill is based upon the original HR 3606, the "Reopening

American Capital Markets to Emerging Growth Companies Act of 2011", introduced on December

8, 2011, by Rep. Stephen Fincher (R-TN) and

Rep. John Carney (R-DE), and reported by the HFSC

on March 1.

It creates a new class of public companies titled "emerging growth companies"

or EGCs. It defines an EGC as "an issuer that had total annual gross revenues of

less than $1,000,000,000 ... during its most recently completed fiscal year". It

also provides numerous forms of regulatory relief for EGCs, including

reduced disclosure requirements, and further Sarbox 404 relief.

See also, story titled "House Financial Services Committee to Mark Up Bill to Provide

Regulatory Relief to Emerging Growth Companies" in TLJ Daily E-Mail Alert No.

2,336, February 14, 2012.

The National Venture Capital Association (NVCA)

stated in a March 8

release that this title creates "a regulatory

on-ramp for companies with less than $1 billion in revenues for up to the first

five years after an IPO. In addition to offering temporary relief from onerous

and costly provisions such as Sarbanes Oxley Section 404b, the measures also

allow for these companies to more effectively communicate with investors before,

during and after the offering, creating additional safe harbors for additional

analyst research coverage and allowing an expanded range of pre-filing

communications."

Title II of the House bill is based upon HR 2940

[LOC |

WW], the "Access

to Capital for Job Creators Act", introduced on September 15, 2011, by

Rep. Kevin McCarthy (R-CA), marked up by the HFSC

on October 26, and passed by the House on November 3.

Title II of the bill as amended by the House amends Section 4 of the Securities Act of 1933,

which is codified at 15 U.S.C. § 77d,

to, among other things, remove the regulatory

ban that prevents small privately held companies from using advertisements to

solicit investors.

Title III of the House bill is based upon the crowdfunding provisions of HR 2930

[LOC |

WW], the

"Entrepreneur Access to Capital Act",

introduced on September 14, 2011, by Rep.

Patrick McHenry (R-NC), marked up by the HFSC on October 31, and

passed by the House on November 3.

It removes statutory and Securities and Exchange Commission

(SEC) restrictions that prevent crowdfunding, which enables raising equity capital from a large

pool of small investors who may or may not be considered accredited by the SEC.

It provides an exemption from Section 4 of the Securities Act of 1933. This exemption would

apply to certain companies that sell less than $1 Million is securities per year

(or $2 Million if the company provides investors an audited financial

statement), and no investor is sold more than the lesser of $10,000 in

securities per year or 10 percent of such investor's annual income.

Rep. McHenry, the sponsor of the crowdfunding bill, issued a release on

March 8 that states that this provides "a crowdfunding exemption to SEC

registration requirements for firms raising up to $2 million, with individual investments

limited to $10,000 or 10 percent of an investor’s income. The legislation also erases limits

on the number of investors that can participate in crowdfunding, extending investment

opportunities to everyday investors that are currently not an option under SEC regulation."

Google's Director of Public Policy, Pablo Chavez, stated in a

release on March 15 that "entrepreneurs need access to capital to make grow

their ideas into successful companies".

"The JOBS Act makes it easier for startups to raise capital. The crowdfunding provisions

drafted by Congressman Patrick McHenry and Majority Leader Eric Cantor are particularly exciting

and we applaud the House for its focus on helping to promote innovation and economic

growth."

Chavez added that "Already, thousands of new companies have been funded by crowdfunding

platforms like Kiva, Kickstarter, and IndieGogo. With the growth of social networks and other

online platforms, crowdfunding is a promising investment model that would allow more Americans

to invest in a new company simply by using the Internet to connect with entrepreneurs."

Title IV of the House bill is based upon HR 1070

[LOC |

WW], the

"Small Company Capital Formation Act", introduced on March 14, 2011, by

Rep. David Schweikert (R-AZ), marked

up by the HFSC on September 14, 2011, and passed by the House on November 2,

2011.

It amends Section 3(b) of the Securities Act of 1933, codified at

15 U.S.C. §

77c(b), to increase the SEC Regulation A exemption threshold from $5 Million to

$50 Million.

Title V is based upon HR 2167

[LOC |

WW], the

"Private Company Flexibility and

Growth Act", introduced on June 14, 2011, by Rep. Schweikert, and marked up by

the HFSC on December 12, 2011.

It amends Section 12(g)(1)(A) of the Securities Exchange Act of 1934, codified at

15 U.S.C. § 78l(g)(1)(A), to raise

the shareholder threshold for mandatory registration with the SEC from 500 to 1,000

shareholders.

|

|

|

| Senators Introduce CROWDFUND Act As Stand

Alone Bill |

|

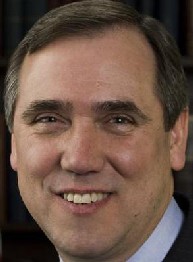

3/13. Sen. Jeff Merkley (D-OR) and others

introduced S 2190

[LOC |

WW], the "Capital

Raising Online While Deterring Fraud and Unethical Non-Disclosure Act of 2012" or

"CROWDFUND Act".

The original cosponsors are Sen. Michael Bennet

(D-CO), Sen. Scott Brown (R-MA), and

Sen. Mary Landrieu (D-LA). It was referred to the

Senate Banking Committee (SBC).

Sen. Merkley (at left) stated in a

release that "The Internet has opened the doors for

business growth and innovation of all kinds. The CROWDFUND Act will allow that

innovation to continue by allowing small investors to pool their resources to

fund promising new ventures". Sen. Merkley (at left) stated in a

release that "The Internet has opened the doors for

business growth and innovation of all kinds. The CROWDFUND Act will allow that

innovation to continue by allowing small investors to pool their resources to

fund promising new ventures".

His release elaborates that "Normally, when a company seeks financing from

the public it must register as a security with the Securities and Exchange

Commission, providing detailed disclosures. The CROWDFUND Act would provide an

alternative to this process, allowing companies to raise up to $1,000,000

annually through crowdfunding on registered internet websites."

This bill is similar to Title III of HR 3606

[LOC |

WW],

as passed by the House on March 8, 2012. However, it also contains many changes.

The SBC's Subcommittee on Securities, Insurance, and Investment will hold a hearing on

March 21 titled "Examining Investor Risks in Crowdfunding". The witnesses will

be Mercer Bullard (University of Mississippi law school), Nick Bhargava

(Motaavi), Dana Mauriello

(ProFounder), and Heath Abshure (Arkansas Securities

Department). See,

notice

Motaavi states in its web site that it is an "integrated exchange and trading

platform where any investor can invest in and trade shares of companies seeking

up to $1M a year."

It adds that "Motaavi addresses two major issues. First, startups and

small businesses face a funding gap which can be fatal to the company. Second,

investments in startups and small businesses have previously been limited to the

very wealthy as a result of antiquated regulation. Because of recent legislative

initiatives, things are changing. Motaavi solves these issues by allowing anyone

to invest in startups and small companies regardless of personal wealth.

Companies can harness the power of crowds, and crowds can spread information and

risk, creating a vibrant and powerful market."

ProFounder, another crowdfunding platform, wrote in its web site on February 12,

2012, that "the current regulatory environment

prevents us from pursuing the innovations we feel would be most valuable to our customers, and

we've made the decision to shut down the company."

|

|

|

| About Tech Law

Journal |

|

Tech Law Journal publishes a free access web site and a subscription e-mail alert.

The basic rate for a subscription to the TLJ Daily E-Mail Alert is $250 per year for

a single recipient. There are discounts for subscribers with multiple recipients.

Free one month trial subscriptions are available. Also, free subscriptions are

available for federal elected officials, and employees of the Congress, courts, and

executive branch. The TLJ web site is free access. However, copies of the TLJ Daily

E-Mail Alert are not published in the web site until two months after writing.

For information about subscriptions, see

subscription information page.

Tech Law Journal now accepts credit card payments. See, TLJ

credit

card payments page.

TLJ is published by

David

Carney

Contact: 202-364-8882.

carney at techlawjournal dot com

3034 Newark St. NW, Washington DC, 20008.

Privacy

Policy

Notices

& Disclaimers

Copyright 1998-2012 David Carney. All rights reserved.

|

|

|

|

| In This

Issue |

This issue contains the following items:

• House Passes Securities Regulation Bill

• Summary of HR 3606

• Senators Introduce CROWDFUND Act As Stand Alone Bill

|

|

|

Washington Tech

Calendar

New items are highlighted in

red. |

|

|

| Monday, March 19 |

|

The House will return from its one week recess. It will

meet at 4:00 PM for legislative business. Votes will be postponed until 6:30 PM.

It will consider two bills under suspension of the rules, including HR 3992

[LOC |

WW]. See, story

titled "House Judiciary Committee Approves Bill to Expand Investor Visa Program"

in TLJ Daily E-Mail Alert No. 2,347, March 6, 2012. See also, Rep. Cantor's

schedule for the week.

The Senate will meet at 2:00 PM. It is scheduled to

consider HR 3606 [LOC

| WW], the

"Jumpstart Our Business Startups Act" or "JOBS Act",.

12:15 - 1:30 PM. The Federal Communications Commission (FCC) will

host an event titled "Meet the 8th Floor Media Advisors". The speakers will

be Sherrese Smith (office of Chairman Julius Genachowski), Erin McGrath (office of

Commissioner Robert McDowell), Dave Grimaldi (office of Commissioner Mignon Clyburn). The

FCBA states that this is an FCBA event. Location: National

Association of Broadcasters, 1771 N St., NW.

3:00 PM. The House

Appropriations Committee's (HAC) Financial Services and General Government will hold a

hearing on the FY 2012 budget for the Federal Communications Commission (FCC). The

witnesses will be FCC Chairman Julius Genachowski and FCC Commissioner Robert

McDowell. See,

notice. The HAC will webcast this hearing. Location: Room 2359, Rayburn Building.

4:00 PM. The House

Intelligence Committee (HIC) will hold a closed hearing titled "Ongoing Intelligence

Activities". See,

notice.

Location: Room HVC-304, Capitol Visitor Center.

|

|

|

| Tuesday, March 20 |

|

The House will meet at 10:00 AM for morning

hour, and at 12:00 NOON for legislative business. See, Rep. Cantor's

schedule for the week.

8:00 -10:00 AM. Broadband Census News LLC

will host a panel discussion titled "Maximizing US Health IT and Broadband

Investments". The speakers will be Sharon Gillett (Chief of the FCC's

Wireline Competition Bureau), Eric Brown (P/CEO

of the California Tele-Health Network), Farzad Mostashari (Department of Health and Human

Services), Michael Sims (Delaware Health Information Network), Jessica Zufolo (Deputy

Administrator of the Rural Utilities Service), and Craig Settles (moderator). Breakfast will

be served. This is open to the public. The price to attend is $47.12. See,

notice and registration page. This

event is also sponsored Comcast, Google, ICF,

National Cable & Telecommunications Association (NCTA),

and Telecommunications Industry Association (TIA).

Location: Clyde's of Gallery Place, 707 7th St., NW.

8:45 AM - 2:00 PM. The Free

State Foundation (FSF) will host an event titled "Fourth Annual Telecom Policy

Conference: The Internet World: Will It Remain Free From Public Utility Regulation?"

The speakers will include Jeffrey Campbell (Cisco), Jim Cicconi (AT&T),

Michelle Connolly (Duke University),

Steve Largent (CTIA), Kyle McSlarrow

(Comcast/NBC Universal), Marius Schwartz (FCC),

Howard Shelanski (Georgetown University Law School), Deborah Tate (FSF), Tom Tauke (Verizon),

Steven Teplitz (Time Warner Cable), Rick Whitt (Google),

Christopher Yoo (University of

Pennsylvania Law School). Free. Open to the public. Lunch will be served. Register to attend

by contacting Kathee Baker at kbaker at freestatefoundation dot org. Location:

National Press Club, 13th Floor, 529 14th St., NW.

10:00 AM. The

Senate Finance Committee's (SFC) Subcommittee on Fiscal Responsibility &

Economic Growth will hold a hearing titled "Tax Fraud by Identity

Theft, Part 2: Status, Progress, and Potential Solutions". See,

notice. Location: Room 215, Dirksen Building.

10:00 AM - 12:00 NOON. The

Senate Banking Committee (SBC) will

hold a hearing on numerous nominations, including Jerome Powell and

Jeremy Stein to be members of the Board of Governors of the Federal

Reserve System. See,

notice. Location: Room 538, Dirksen Building.

2:30 PM. The Senate

Intelligence Committee (SIC) will hold a closed hearing. See,

notice. Location: Room 219, Hart Building.

11:59 PM EDT. Deadline to submit FY 2012 Form 471 to the Federal

Communications Commission's (FCC) Universal Service

Administration Company (USAC). This is the e-rate subsidy program's Services Ordered

and Certification Form .

|

|

|

| Wednesday, March 21 |

|

The House will meet at 10:00 AM for morning

hour, and at 12:00 NOON for legislative business. See, Rep. Cantor's

schedule for the

week.

9:30 - 11:30 AM. The

Senate Banking Committee's (SBC) Subcommittee on

Securities, Insurance, and Investment will hold a hearing titled "Examining Investor

Risks in Crowdfunding". The witnesses will be Mercer Bullard (University of

Mississippi law school), Nick Bhargava (Motaavi),

Dana Mauriello (ProFounder), Heath Abshure

(Arkansas Securities Department). See,

notice. Location: Room 538, Dirksen Building.

10:00 AM. The House

Judiciary Committee's (HJC) Subcommittee on Crime, Terrorism, and Homeland Security

will hold a hearing titled "Secure Identification: The REAL ID Act's Minimum

Standards for Driver's Licenses and Identification Cards".

The witnesses will include David Heyman (DHS Assistant

Secretary for Policy). See,

notice.

The HJC will webcast this event. Location: Room 2141, Rayburn Building.

10:30 AM. The Federal Communications Commission

(FCC) will hold an event titled "Open Meeting". See,

agenda. Location: FCC, Commission Meeting Room, 445 12th St., SW.

12:00 NOON - 1:30 PM. The DC Bar

Association will host an event titled "Data Breach Risks and Protections for

Health Lawyers: Do You Know Where Your Information is Today?". The speakers will

be Alan Goldberg

(George Mason University and American University law schools),

Jonathan Joseph (Christian

& Barton), and Melinda Murray (Holy Cross Hospital, Silver Spring). The price to attend

ranges from $15 to $35. No CLE credits. See,

notice. For more information, call 202-626-3463. The DC Bar has a history of barring

reporters from its events. Location: DC Bar Conference Center, 1101 K St., NW.

1:30 PM. The House

Judiciary Committee's (HJC) Subcommittee on Courts, Commercial and Administrative Law

will hold a hearing titled "Office of Information and Regulatory Affairs: Federal

Regulations and Regulatory Reform under the Obama Administration". See,

notice. The HJC will webcast this event. Location: Room 2141, Rayburn

Building.

2:00 PM. The Senate

Judiciary Committee's (SJC) Subcommittee on Antitrust, Competition Policy and Consumer

Rights will hold a hearing titled "The Verizon/Cable Deals: Harmless Collaboration

or a Threat to Competition and Consumers?". The witnesses will be

Randal Milch (Verizon), David Cohen (Comcast),

Rick Rule (Cadwalader

Wickersham & Taft, and Microsoft's outside antitrust counsel), Steven Berry

(Rural Cellular Association), Joel Kelsey (Free Press), and

Timothy Wu

(Columbia University law school). See,

notice. The SJC will webcast this event. Location: Room 226, Dirksen Building.

2:00 PM. The House

Oversight and Government Reform Committee (HOGRC) will hold a hearing titled "FOIA

in the 21st Century: Using Technology to Improve Transparency in Government". See,

notice. Location: Room 2154, Rayburn Building.

2:00 - 6:00 PM. The Federal

Communications Bar Association's (FCBA) Privacy and Data Security Committee and the

American Bar Association's (ABA) Communications Law Forum will host an event titled

"7th Annual ABA/FCBA Privacy & Data Security Symposium". CLE credits.

Prices vary. Registrations and cancellations are due by 5:00 PM on March 16. See,

notice. Location: Arnold & Porter,

555 12th St., NW.

6:00 - 8:00 PM. The Federal

Communications Bar Association's (FCBA) will host an event titled "Happy

Hour". Location: __.

Deadline to register to attend the Federal

Communications Bar Association's (FCBA) lunch on March 28 at which Jamie Barnett, Chief

of the FCC's Public Safety and Homeland Security

Bureau, will speak.

|

|

|

| Thursday, March 22 |

|

The House will meet at 9:00 AM for legislative

business. See, Rep. Cantor's

schedule for the

week.

9:00 AM. The House

Intelligence Committee (HIC) will hold a closed hearing titled "Ongoing

Intelligence Activities". See,

notice.

Location: Room HVC-304, Capitol Visitor Center.

10:00 AM. The House

Financial Services Committee's (HFSC) Subcommittee on Financial Institutions and Consumer

Credit will hold a hearing titled "The Future of Money: How Mobile Payments Could

Change Financial Services". See,

notice. Location: Room 2128, Rayburn Building.

10:00 AM. The Senate

Judiciary Committee (SJC) will hold an executive business meeting. The agenda again

includes consideration of the nomination of Richard Taranto to be a Judge of the

U.S. Court of Appeals (FedCir),

and Robin Rosenbaum to be a Judge of the U.S. District Court for the Southern

District of Florida. The SJC will webcast this event. Location: Room 226,

Dirksen Building.

10:00 AM. The Senate

Appropriations Committee (SAC) will hold a hearing on the FY 2013 budget for the

Department of Commerce (DOC). Location:

Room 192, Dirksen Building.

10:00 AM - 12:00 NOON. The American

Enterprise Institute (AEI) will host a panel discussion titled "Chinese Telecom

Investment in the U.S.: Weighing Economic Benefits and Security Risks". The speakers

will be Claude Barfield (AEI),

Theodore Moran (Georgetown University),

Derek Scissors (Heritage

Foundation), and

Timothy Keeler (Mayer Brown). See,

notice. The AEI will webcast this event. Location: AEI, 12th floor, 1150 17th

St., NW.

2:30 PM. The Senate

Intelligence Committee (SIC) will hold a closed hearing. See,

notice. Location: Room 219, Hart Building.

Day one of a two day event hosted by the Air Force

Association (ASA) titled "Cyber Futures Conference and Technology Exposition".

See, notice. Location:

Gaylord National Hotel, Maryland Ballroom, 201 Waterfront St.Oxen Hill, MD.

|

|

|

| Friday, March 23 |

|

Rep. Cantor's

schedule for the

week states that "no votes are expected in the House".

Supreme Court conference

day. See,

calendar. Closed.

Day two of a two day event hosted by the Air Force

Association (ASA) titled "Cyber Futures Conference and Technology Exposition".

See, notice. Location:

Gaylord National Hotel, Maryland Ballroom, 201 Waterfront St.Oxen Hill, MD.

|

|

|

| Saturday, March 24 |

|

9:00 AM - 2:30 PM. The DC Bar

Association will host an event titled "Youth Law Fair. Privacy Awareness:

Managing Social Media Networks". This free event is intended for students and

parents. Registration closed by early February. The speakers will be Judge Melvin Wright

(DC Superior Court), Curtis Etherly (Coca-Cola), and Marsali Hankcock (iKeepSafe). See,

DC Bar

notice and registration page. For more

information, call 202-626-3463. The DC Bar has a history of barring reporters from its

events. Location: DC Superior Court, Room 3300, 500 Indiana Ave., NW.

|

|

|

| Monday, March 26 |

|

The House will meet. Votes will be postponed until 6:30 PM.

POSTPONED. 12:30 - 2:00 PM. The

Federal Communications Bar Association (FCBA)

will host a brown bag lunch titled "The Impact of the New Legislation on

Public Safety Communications". Location: Harris Corporation, Suite 850E,

600 Maryland Ave., SW.

|

|

|